Does your business accept contactless payments via Apple Pay, Google Pay, and Samsung Pay? If not, you probably should—it’s what customers want.

What Are Contactless Payments?

Contactless payments, also called mobile payments, NFC payments, or proximity payments, are payment transactions that take place digitally via a mobile device or NFC-enabled credit/debit card. Today’s Apple and Android smartphones come with mobile wallet apps that store users’ credit card information on the phones themselves. To make a payment, the customer simply unlocks the phone, holds it near a mobile processing terminal, and the payment information is transmitted via near field communication (NFC) technology. No cards need to be physically run through a card reader.

Customers Like Contactless Payments

More and more customers are paying with their phones. For customers, making a mobile payment is faster and more convenient than pulling a physical credit card from their wallets. All they have to do is hold out their phones, wait for the beep, and they’re done.

Contactless payments are also popular from consumers still reeling from the COVID-19 pandemic. Paying via phone is more sanitary than using a physical credit card. There’s nothing to touch and nothing to transmit germs.

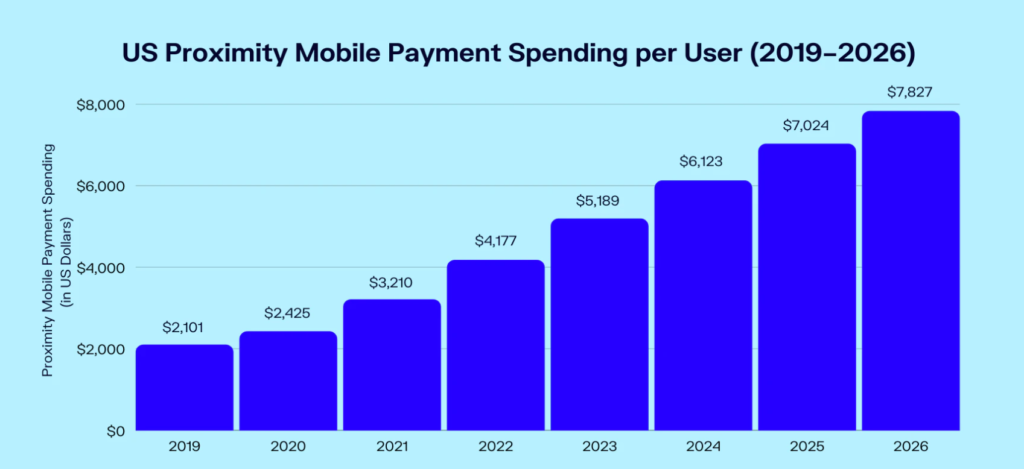

This popularity is reflected in the numbers. According to eMarketer, the average consumer will make more than $5,000 in contactless payments this year, up from a little over $4,000 in 2022. That number is expected to increase over 50% by 2026. If you’re not accepting contactless payments, you’re missing out on some of these sales.

Merchants Like Contactless Payments

Merchants like contactless payments for the same reasons customers due. Contactless payments are convenient, don’t require the physical handing of credit cards, and ultimately generate more revenue. Customers who don’t want to pay via cash, check, or credit card can easily pay with their phones.

Contactless payments are easy to set up, requiring only a minimal equipment investment. They’re also easy for employees to manage, just by pointing customers to or presenting a mobile card reader. You can augment security by requiring customers enter a PIN or just go with the mobile scan.

Higher Standards Can Help You Accept Contactless Payments

With more and more customers shifting from physical credit cards to mobile payments via their smartphones, it’s time for your business to get on board the mobile payment bandwagon. We carry a variety of terminals from Clover that enable contactless mobile payments. Talk to your Higher Standards expert advisor or contact us online to learn more about your mobile payment options and start accepting mobile payments from your customers!

CLICK HERE TO LEARN MORE ABOUT CONTACTLESS PAYMENTS WITH HIGHER STANDARDS